A separate account such as inventory write-off expense account is included with the other inventory accounts. For instance your promise to pay the bank car loan credit card debt mortgage is an asset to them.

How To Prepare A Profit Loss Statement It S Easy With Our Free Template Digital Com

How To Prepare A Profit Loss Statement It S Easy With Our Free Template Digital Com

Your Credit Scores Should Be Free.

Profit and loss write off. The loss this account should appear on the income statement each time inventory is written off. A write-off is used to reduce or eliminate the value an asset and reduce profits In everyday English that means the lender has decided that one of its assets isnt as valuable as they say it is on the corporate books. Ask a lawyer - its free.

And Now They Are. The debt may say charged off or uncollected bad debt or any number of different things. You are running your profit loss statement on a CASH BASIS.

From an accounting standpoint that means they remove that anticipated income from their accounts receivables ledger and document the loss as charged off to bad debt or written off to bad debt at that point. Profit and loss templates give you the information you need when you need it for peace of mind and transparency. A fixed asset is written off when it is determined that there is no further use for the asset or if the asset is sold off or otherwise disposed of.

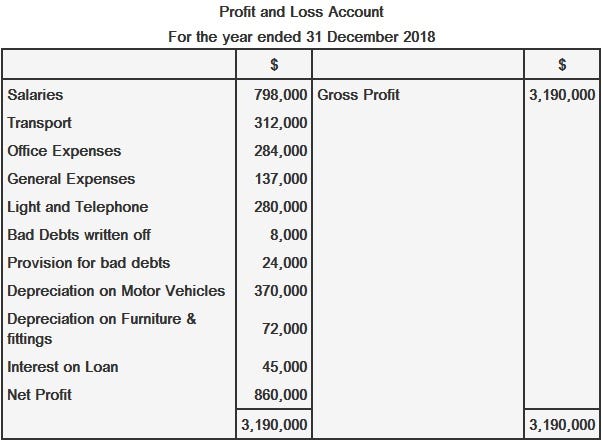

That will make your credit even worse. Your income will increase by the amount of the bad debt written off but you will also have and expense Bad Debt Expense in the same amount so they cancel each other out and net income remains unpaid. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time.

I have three profit and loss write-offs on my credit report and two have turned into judgements wondering if this means the third is a judgement even though I have received no paperwork saying it is so. Charged off and written off mean the same thing. What is a Write-Off.

However if youre writing off large dollar amounts of inventory it has to be disclosed on your income statement. The procedure for writing off bad debt is correct. Traditionally creditors will charge-off an account after six months 180 days without payment.

A write-down is performed in accounting to reduce the value of an asset to offset a loss or expense. The PL statement shows a companys ability to generate sales manage expenses and create profits. This occurs when a consumer becomes severely delinquent on the debt.

Disposal of Fixed Assets Double Entry Example. A profit and loss charge-off is when a borrower becomes delinquent on an outstanding debt and the lender writes off the debt. A charged off or written off debt is a debt that has become seriously delinquent and the lender has given up on being paid.

Nip it in the bud now. The PL write-off merely means they have written off the debt as a tax loss and will likely turn the account over to their internal or external collection company or collection lawyer. Title Submit to the Community The Credit Advice pages of the Site may contain messages submitted by users over whom Credit Karma.

Profit and loss write-off. A write off involves removing all traces of the fixed asset from the balance sheet so that the related fixed asset account and accumulated depreciation account are reduced. A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a loss on disposal.

Instead the loss is included in with the COGS amount. The difference between a write-off and a write-down is just a matter of degree. A write-down also lowers asset book value but it does not take the value to 0.

In either case the loss enters the accounting system as an expense. Just plug in revenue and costs to your statement of profit and loss template to calculate your companys profit by month or by year and the percentage change from a prior period. Reply to this Question.

Firms sometimes have to admitformally and publiclythat certain assets have lost value. When they take a write off for the unpaid balance of debt they reflect this fact on your credit report. There are a few ways that a profit and loss write off on credit bureau report may show up.

If youre writing off small amounts of inventory you dont require separate disclosure on the income statement. Collections often tend to have babies on credit reports. W rite-off is an accounting term referring to an action whereby the book value of an asset is declared to be 0.

View your scores and reports anytime. Ergo and accounting adjustment of stated profit and loss by the business and a tax writeoff. A profit and loss write off on credit bureau report is really just a fancy way of saying that the credit card company decided that a given debt wasnt worth collecting and took a write-off for it.

There are two scenarios under which a fixed asset may be written off. Also known as a Profit and Loss Write-off a charge-off or chargeoff is the declaration by a creditor that a debt is unlikely to be collected. A charge-off is an accounting practice wherein a debt is removed from the creditors accounting ledger as an asset an account receivable and moved to a business loss as a bad debt that is not expected to ever be paid.

January 19 2016 Reply. A business has fixed assets that originally cost 9000 which have been depreciated by 6000 to the date of disposal. Three common scenarios requiring a business write-off include unpaid.

Credit score Credit Debt. A write-off primarily refers to a business accounting expense reported to account for unreceived payments or losses on assets. This does not mean that you are free from the debt it just means that the company has given up on collecting the debt from you in the normal fashion.

Popular Posts

-

Gretel Hansel202064. The Cabinet of Dr. Horror Movies Photo Polish Covers Horror Movies Scariest Horror Movies Scary Movies Although the ...

-

What is the best eyeshadow for blue eyes and blonde hair. It is easy to do and only needs black eye-shadow with good mascara as the primary ...

-

02 There was only one tea partier that got harmed during the Boston Tea Party. The Americans were protesting both a tax on tea taxation with...

Featured Post

should cats eat fish

Truth About Feeding Fish to Your Cat Hill's Pet . Web First off, fish is a great source of protein, whether you are a cat, or a c...

ads